Key Changes in the 2026 Year-End Tax Settlement (Korea)

Your 13th Month Salary! Let's Double-Check Income and Tax Deductions

Hey diptok Fam! It's Ah-Young here! 👋

Can you believe it's already December? Am I the only one in shock? Once you catch your breath and look at the calendar, there’s one thing you can't escape in December: the Year-End Tax Settlement. As the season approaches, it’s easy to feel anxious. 'Did I miss something?' 'Is there a new rule I don't know about?' Even when we think it’ll be the same as last year, we usually end up missing at least one crucial point.

So, I’ve summarized the actual changes for the 2026 settlement (based on 2025 income) compared to last year. I’ve focused on the changes that we can really feel in our wallets. Let’s make sure we claim every won we deserve!

1. Child Tax Credit: The Numbers Have Definitely Changed

To be honest, in previous years, the 'increase' in child tax credits didn't feel that significant. However, starting with the 2026 settlement, the amounts have been updated as follows:

- First child: 250,000 KRW (Previously 150,000 KRW)

- Second child: 300,000 KRW (Previously 200,000 KRW)

- Third child or more: 400,000 KRW per child (Previously 300,000 KRW)

The deduction per child has clearly grown. If you have two or more children, you’ll notice a visible difference in your refund. For example, if you have three children, you previously received 650,000 KRW; now you’ll get 950,000 KRW—a 300,000 KRW increase!

2. Monthly Rent Tax Credit: More Advantageous for Renters

There are also big changes for those living in monthly rentals (non-homeowners). I remember how much this tax credit helped me when I was renting during my previous job. If a large portion of your income goes toward rent, pay close attention:

- Deductible Rent Limit: 7.5 million KRW → 10 million KRW

- Tax Credit Rate: 15% to 17% depending on total annual salary.

3. Housing Subscription Savings: Higher Deduction Limit

(Only for workers with a total annual salary of 70 million KRW or less) The rules for the Housing Subscription Savings (housing lucky draw account) for non-homeowners have also changed.

- Annual Deduction Limit: 2.4 million KRW → 3 million KRW

- Benefit: 40% of the payment amount is deducted from taxable income.

Previously, it felt like the limit was too small to be meaningful, but things are different now. You can get an income deduction of up to 1.2 million KRW (40% of 3 million KRW). It seems the Ministry of Economy and Finance adjusted this because these accounts have been losing popularity lately. If you don't own a home yet, it’s definitely worth keeping this account active for the tax benefits alone.

4. Gyms and Swimming Pools Are Now Deductible

(Only for workers with a total annual salary of 70 million KRW or less) Here is some great news! Starting with the 2026 settlement, fees for certain sports facilities like gyms and swimming pools are included in the 'Culture Expense' income deduction. Previously limited to books, performances, and movies, the scope has now expanded.

- Deduction Rate: 30% of the usage fees paid.

- Limit: Up to 3 million KRW (total for culture expenses).

For example, if you earn 50 million KRW a year and spent 1.2 million KRW on a gym membership, 30% of that (360,000 KRW) is recognized as an income deduction. Depending on your tax bracket, this could lead to a nice little refund!

5. New Marriage Tax Credit

The 'Marriage Tax Credit' is a temporary system active from 2024 to 2026, so I wanted to mention it again.

- Benefit: 500,000 KRW tax credit per person in the year of marriage registration.

- Application: Both husband and wife can apply (totaling 1 million KRW for the couple).

- Condition: Applies only once in a lifetime.

6. Hometown Love Donation: Limits Significantly Increased

Until last year, this was a niche system, but with more online advertising, it seems everyone knows about it now.

- Donation Limit: 5 million KRW → 20 million KRW

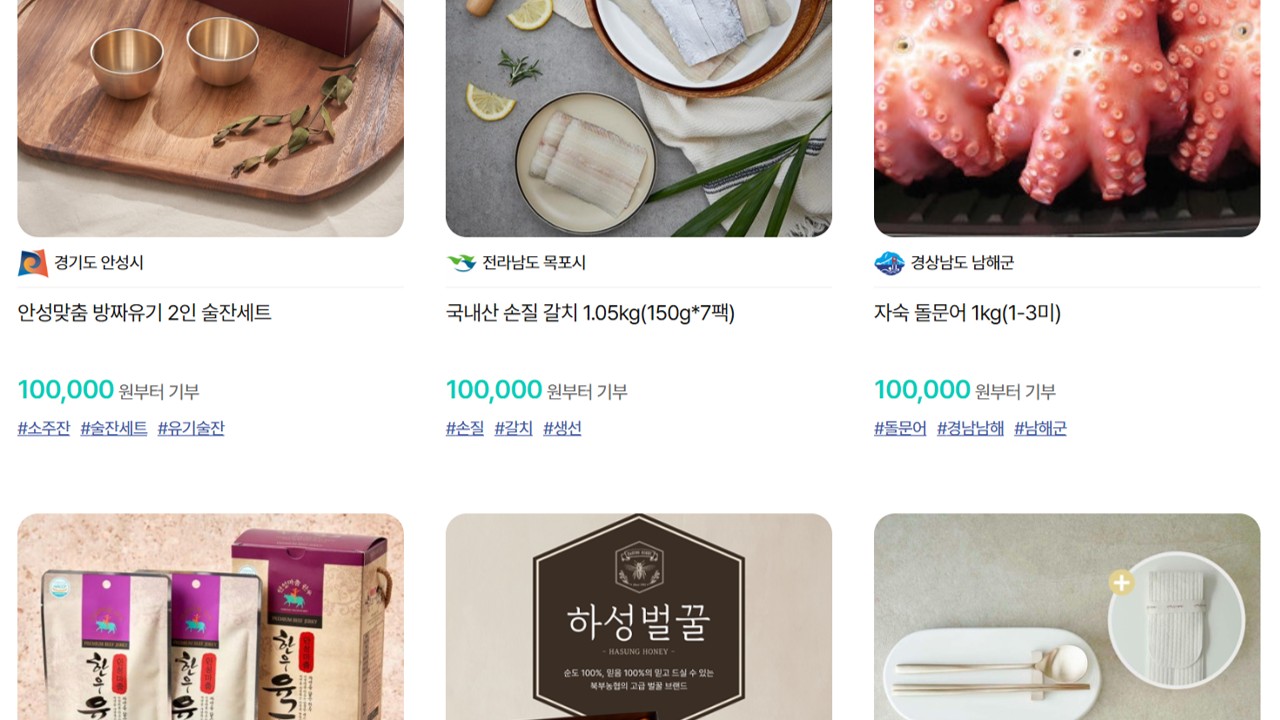

The best part? Donations up to 100,000 KRW are fully tax-credited, meaning you get the entire amount back. Plus, if you donate through the official sites, you get 'return gifts' for free. (I received kimchi last year, and it was so delicious... 🤤)

👋 Hometown Love Donation (Wegive)

Closing Thoughts

To wrap it up:

- If you live alone: Focus on Monthly Rent and Culture Expenses.

- If you have a family: Check the Child and Marriage Credits.

- For your health: Gym and exercise spending are now reflected.

When tax season arrives, it starts with money but ends with reflecting on how we lived the past year. How much we earned, what kind of life we led, and whether we are truly okay living this way next year.

On nights when these thoughts flood in, sometimes you don't want to deal with numbers. You just want to chat with someone—anyone—about your life without any specific agenda. It can be awkward to talk to friends about your exact salary or how you spent your money. In those moments, you might just want to ask an anonymous community or a 'bamboo forest' if you've been doing a good job.

diptok or random chat might not give you the 'exact' answer, but sometimes a non-calculative, sincere word from a stranger can comfort a heart exhausted by tax forms. Let's try to miss fewer deductions and feel a little less alone this year.

References & Sources

- National Tax Service HomeTax, "Guide to 2025 Income Year-End Tax Settlement"

- Ministry of Economy and Finance, "2024-2025 Tax Law Amendment Proposal"

- KB Financial Group KB Think, Tax Settlement System Summary

- National Tax Service Press Release (Child/Marriage Tax Credit, Rent Credit Reform)

- Ministry of the Interior and Safety, Hometown Love Donation Information Materials

Hope my story brought you a little comfort tonight. If you ever need a chill spot to chat about these things in the late-night hours, why not give diptok a try and start your own honest conversation? 💜